Date: Mon, 3 February 2020

Author: Tommy Stubbington

Source: msn.com

Sweeping through bonds markets earlier this month was a rally that left investors who had bet on higher yields confounded with the expansion of the global tally of negative-yielding debt to more than $13 trillion.

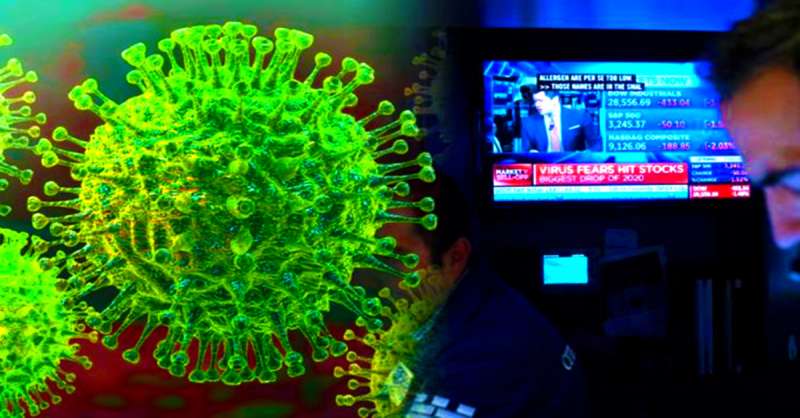

Alarmed over the outbreak of the coronavirus in China, investors are impelled to discard risky assets. An estimate of $1.4 trillion was wiped off the value of global stocks since mid-January and in its place, investors have turned to the safest government debt.

The U.S. 10-year bond yield impacted a three-month low of 1.57 percent on Tuesday, echoing an increase in prices. German 10-year yields have hit their lowest since October at minus 0.4 percent. Japanese yields also dropped this year.

The moment there was evidence that not everything was so optimistic, people easily gave up on those trades in the blink of an eye.

The acceleration into government debt interrupts a global sell-off that started in the autumn after an upturn in the global economy and there was a perception that central banks had ran out of stimulus options driving an exodus from very low-yielding debt. Many fund managers whom predicted the selling to extend into 2020 have been identified amidst of growing worries regarding the impact of the virus on China’s economy.

“The bottoming out of global growth was supposed to unleash this reflationary wave that would see bonds sell off,” says Nick Wall, a fund manager at Merian Global Investors. “But as soon as there was evidence that not everything was so optimistic, people gave up on those trades very quickly. A lot of people have closed out their positions.

The debt rally underscores the enduring appeal of bonds as a counterweight that gains when riskier investments decline. “U.S. Treasuries are one of the best insurance policies you can have in your portfolio,” says Andrea Iannelli, investment director at Fidelity International. “Whenever things get messy, that’s what you want to own.”

Iannelli adds, the asset manager prefers U.S. government bonds as the Federal Reserve having the liberty to cut interest rates should weaken China resulting a spill over into a broader global slowdown.

Globally, bond markets stayed short of the extreme levels hit in August and September last year during the period $17 trillion of bonds carried a sub-zero yield. Even so, that sub-zero total has expanded by more than $2 trillion since mid-January.

The scale and speed of the bond rally has pushed yields back to levels that indicate a depressing vision for our global economy. It left even some bond bulls wary.

Shifts in the Treasury market indicates that the U.S. yield curve is close to inverting. In other words, longer-term yields fall below short-term yields as it did for much of last year. Previously, such an inversion has been a pointer that a recession is on the way. While most investors trust this year will bear modesty if not for unimpressive progression.

“Generally, whenever we have seen a big government bond sell-off I have been a buyer,” says Mike Riddell, a fixed income portfolio manager at Allianz Global Investors.

“But we are a bit bearish [on bonds] at these levels,” he continues. “Given the direction of global data, the rally looks a bit overdone. You can rationalize it by saying that because of coronavirus the growth outlook is far worse, but I’m not sure that’s what the market really thinks.”

Keyword: sterlinghousetrust.com, Sterling House Trust, SHT

Sterling House Trust is a private trust with a difference. It offers its members an exclusive and reliable platform to access unique opportunities and lifestyle services reserved for the select few. With its team of professional managers Sterling House Trust constantly scans the markets and collaborate with reliable global partners to create a portfolio of carefully curated programmes for its members. Members can access these programmes according to their individual needs, interest and financial capacity. Sterling House Trust is headquartered in Auckland, New Zealand, and has operations based in London, UK.

The Sterling House Trust platform was established with the objective of providing its members, secure access to opportunities across a range of global locations, sectors and services.

Our unique Platform was established within the framework of a trust so that the trust would have oversight and governance over the range of services and its quality. Member protection is a core principle and drive in all that we do. Our trustees ensures that the interests and quality of service provided by the Platform are always maintained at the highest standards.

The trust and its trustees provide robust oversight and is constantly on the move to identify and shortlist select opportunities in the international markets. Likewise, we apply the same stringent standards in identifying and selecting providers and professional partners to join our Platform.

The Sterling House Trust Platform utilises our international footfall and relationships to provide our members with access to a range of international opportunities via our global network which covers a broad range of sectors including:

Asset protection, international property ownership and management, alternative and direct ownership, estate planning, banking services, foreign exchange, card services, alternative investment and lifestyle services.

New Zealand Head Office

31/335 Lincoln Road,

Addington

Christchurch

New Zealand

London Office

14-16 Dowgate Hill,

London,

England EC4R 2SU