Date: Wed , 23 September 2020

Authors: Saket Sundria and James Thornhill

Date: Wed, 23 September 2020

Source: Yahoo Finance

Oil continues to decline even as concerns for a resurgent coronavirus will lead to more demand-sapping restrictions. An industry report painted a mixed picture of the supply situation in the U.S.

In New York, oil futures for November delivery dropped toward $39 a barrel after rising 0.7% Tuesday. The American Petroleum Institute reported crude stockpiles increased by nearly 700,000 barrels last week, while gasoline inventories shrunk by 7.7 million barrels, according to people familiar.

With the coronavirus infections on the rise again some European countries -- including the U.K. and France – and the U.S. death toll topped 200,000, the recovery in the American economy remains highly uncertain and will need further support, said Federal Reserve Chairman Jerome Powell on Tuesday.

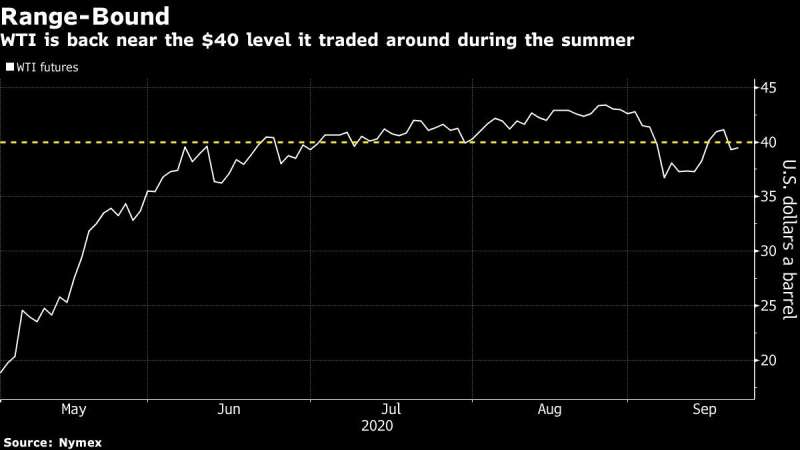

Oil prices are now back in the range as they were in during the northern-hemisphere summer, recovering slightly from the sharp drop from earlier this month. With the demand outlook deteriorating in recent weeks, attention is now turning to the OPEC+ alliance and whether it will try to cut output to defend the market.

“Oil is totally in uncharted territory,” said Stephen Innes, chief global market strategist at AxiCorp Ltd. In the absence of a vaccine, the oil demand recovery has run its course and the resurgence of Covid-19 is worrying, but governments will be reluctant to impose full lockdowns again, he said.

The recent sell-off is likely to have put OPEC+ on guard, and Saudi Arabia has been pushing hard to increase compliance with agreed production quotas, Bank of America Merrill Lynch said in a note dated Sept. 18. Oil prices will probably stay range-bound in the mid-$40s until distillate demand recovers, it said.

Keyword : sterlinghousetrust.com, Sterling House Trust, SHT

Sterling House Trust is a private trust with a difference. It offers its members an exclusive and reliable platform to access unique opportunities and lifestyle services reserved for the select few. With its team of professional managers Sterling House Trust constantly scans the markets and collaborate with reliable global partners to create a portfolio of carefully curated programmes for its members. Members can access these programmes according to their individual needs, interest and financial capacity. Sterling House Trust is headquartered in Auckland, New Zealand, and has operations based in London, UK.

The Sterling House Trust platform was established with the objective of providing its members, secure access to opportunities across a range of global locations, sectors and services.

Our unique Platform was established within the framework of a trust so that the trust would have oversight and governance over the range of services and its quality. Member protection is a core principle and drive in all that we do. Our trustees ensures that the interests and quality of service provided by the Platform are always maintained at the highest standards.

The trust and its trustees provide robust oversight and is constantly on the move to identify and shortlist select opportunities in the international markets. Likewise, we apply the same stringent standards in identifying and selecting providers and professional partners to join our Platform.

The Sterling House Trust Platform utilises our international footfall and relationships to provide our members with access to a range of international opportunities via our global network which covers a broad range of sectors including:

Asset protection, international property ownership and management, alternative and direct ownership, estate planning, banking services, foreign exchange, card services, alternative investment and lifestyle services.

New Zealand Head Office

31/335 Lincoln Road,

Addington

Christchurch

New Zealand

London Office

14-16 Dowgate Hill,

London,

England EC4R 2SU