Date: Wed, 15th June 2020

Author: Philip Stafford, Philip Georgiadis and Hudson Lockett

Source: Financial Times

On Monday, the US stock markets staged a turnround with prices rallying after the Federal Reserve said it would begin buying the debt of US companies to help support the economic recovery.

Early sharp declines was seen in shares on Wall Street but S&P 500 index closed 0.8 per cent higher and the tech-heavy Nasdaq rose 1.4 per cent.

The Fed’s move to buy “a broad, diversified market index” of corporate debt had been announced three months ago. But it helped shift attention from fears that rising coronavirus cases in some parts of the US and China would thwart efforts to kick-start the world’s two biggest economies.

The jump of infections in some cities had divided investors, and benchmarks had fallen earlier in the day, extending the pattern of recent trading sessions.

“Our view is that this sell-off won’t last, and that most risky assets will make more headway this year, as economies continue to recover from their lockdown-induced slumps,” said Simona Gambarini, an economist at Capital Economics in London. “Crucially, though, this view is conditional to the outbreaks remaining localised, and renewed lockdowns not becoming widespread.”

The late gains for equities brought out more adventurous traders. The Vix volatility index, a measure of expected swings in the S&P 500 that is commonly called Wall Street’s “fear gauge”, erased its sharp early gains to trade down 1.6 percentage points.

Investors switched out of the safety of government bonds, sending the yield on the US 10-year Treasury, viewed as a haven asset during times of uncertainty, up 0.016 percentage points to 0.715 per cent. Yields rise when prices fall.

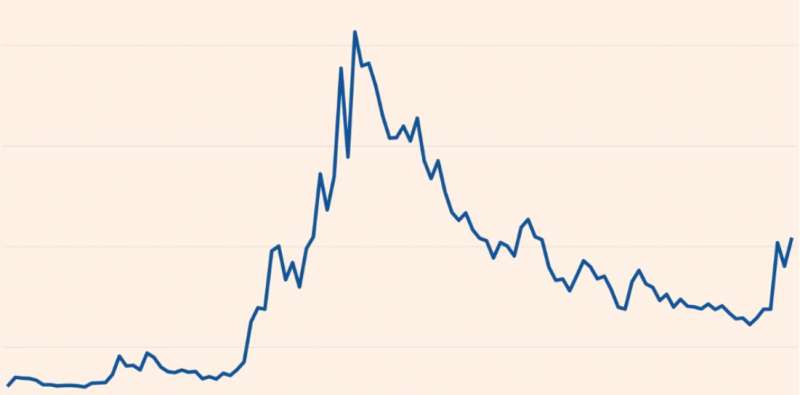

Equity markets’ nervousness had followed a rapid global rally fuelled by central bank stimulus and hopes of a V-shaped economic recovery. It brought the US equity market, for example, to within 6 per cent of its pre-coronavirus levels.

Sebastien Galy, a strategist at Nordea Asset Management, said many investors had assumed there was no room for markets to move higher.

“Such dislocations are often an opportunity and we would posit a third wave upward in the equity market partially disconnected from fundamentals and driven by the quantitative easing of central banks,” he said.

The gains on US equities markets contrasted with other global centres. In Europe, which closed before the Fed’s announcement, the Stoxx Europe 600 benchmark fell 0.3 per cent and the FTSE 100 lost 0.7 per cent.

South Korea’s Kospi, which is packed with exporters that are sensitive to economic disruption, led the falls in Asia with a decline of 4.9 per cent.

Japan’s benchmark Topix dropped 2.5 per cent while Hong Kong’s Hang Seng fell 2.2 per cent and China’s CSI 300 slipped 1.2 per cent.

Monday’s losses came after almost 80 new coronavirus infections were recorded in Beijing over the weekend, many linked to a seafood and vegetable wholesale market. Until the latest outbreak, the Chinese capital had gone more than 50 days without a new case.

The potential for a new surge of infections in China, where the virus originated, has raised the prospect of new lockdowns that could derail the country’s fledgling economic recovery. China’s National Bureau of Statistics said on Monday that industrial production in May rose 4.4 per cent year on year, higher than the month earlier but still below some analysts’ expectations.

Betty Wang, senior China economist at ANZ, said: “The recovery remains quite moderate with a slow improvement in the jobless rate and amid risks of a second wave of coronavirus infections.”

In the US, Covid-19 infections increased by more than 25,000 over the weekend, with states including Texas and Florida reporting record rises after reopening their economies.

Brent crude oil, the international benchmark, rose 2.5 per cent to $39.72 on hopes of a pick-up in demand. West Texas Intermediate, the US benchmark, gained 2.2 per cent to $37.07.

Keyword : sterlinghousetrust.com, Sterling House Trust, SHT

Sterling House Trust is a private trust with a difference. It offers its members an exclusive and reliable platform to access unique opportunities and lifestyle services reserved for the select few. With its team of professional managers Sterling House Trust constantly scans the markets and collaborate with reliable global partners to create a portfolio of carefully curated programmes for its members. Members can access these programmes according to their individual needs, interest and financial capacity. Sterling House Trust is headquartered in Auckland, New Zealand, and has operations based in London, UK.

The Sterling House Trust platform was established with the objective of providing its members, secure access to opportunities across a range of global locations, sectors and services.

Our unique Platform was established within the framework of a trust so that the trust would have oversight and governance over the range of services and its quality. Member protection is a core principle and drive in all that we do. Our trustees ensures that the interests and quality of service provided by the Platform are always maintained at the highest standards.

The trust and its trustees provide robust oversight and is constantly on the move to identify and shortlist select opportunities in the international markets. Likewise, we apply the same stringent standards in identifying and selecting providers and professional partners to join our Platform.

The Sterling House Trust Platform utilises our international footfall and relationships to provide our members with access to a range of international opportunities via our global network which covers a broad range of sectors including:

Asset protection, international property ownership and management, alternative and direct ownership, estate planning, banking services, foreign exchange, card services, alternative investment and lifestyle services.

New Zealand Head Office

31/335 Lincoln Road,

Addington

Christchurch

New Zealand

London Office

14-16 Dowgate Hill,

London,

England EC4R 2SU